The Collapse of Terra, and how it happened

Feels like a 2008 Financial Crisis but Crypto-style, live in action for everyone to witness

Yeah, another article. New day, new stories. :”))

Historical Events

Asian Financial Crisis (1997)

During the Asian Financial Crisis of 1997, billionaire George Soros and his other hedge fund managers executed a well-coordinated manipulation of currencies in an attempt to destabilize the ASEAN economies. By selling a large amount of Thai Baht, it quickly exhausted the Bank of Thailand’s $30 billion foreign exchange reserves, eventually forcing them to implement a floating exchange rate system. This further pushed the other Southeast Asian countries into the depths of this financial crisis.

Great Recession (2008)

Fast forward to 2008. We were faced with another severe financial crisis that almost destroyed the modern financial system. Lehman Brothers, along with many other banks, was heavily exposed to mortgage-backed securities that turned into toxic assets when the underlying loans began to default. As a result, Lehman Brothers was forced to file for bankruptcy, while the Feds have to step in to save Bear Stearns from completely failing. This spurred the Great Recession that lasted about 18 months.

Anyone with basic economic knowledge would be aware of these events, since they have been labeled as historical financial crises, and we even have people using them as case studies. Who would have thought that in just the span of 10 years, such a crisis would happen again, this time in the crypto markets.

Interestingly, due to the transparency that the blockchain offers, we are all able to witness this “live”.

What happened?

On 10th May 2022, Terra's algorithmic stablecoin UST was faced with a debt crisis, resulting in a severe depeg from the dollar, falling as low as $0.60. Within the span of 2 days, the second largest blockchain with over $20 billion TVL, collapsed just like the Lehman Brothers.

Margin Call: Death Spiral to UST

Terra, being the second largest public blockchain within the crypto markets, had its fair share of controversy. On one hand, the minting mechanism of LUNA-UST has allowed Terra to successfully popularize its algorithmic stablecoin UST onto the entire crypto market, which swiftly boosted LUNA's price and market value. On the other hand, Anchor Protocol has been widely seen as an "advertising machine" for UST, leading many to conclude that this will be an unsustainable Ponzi scheme.

For a long time, there has been a clear dichotomy between LUNA supporters and skeptics. Supporters are known as "Lunatics", and they are all over Twitter refuting (sometimes attacking) Luna critics. Skeptics, on the other hand, believe strongly that this is a Ponzi scheme, waiting for the day everything comes crashing down. This has also attracted foreign attackers who are constantly monitoring any industry movements, waiting for their best opportunity to strike.

Opportunity finally arrived after the Federal Reserve announced an increase in interest rates by 50 basis points. Throughout May, the Nasdaq continues to decline, and the markets harbour negative outlook on the economy. The price of Bitcoin consistently declines about 10%, and fear is looming across the entire cryptocurrency market. Luna Foundation Guard (LFG), Terra's own nonprofit organization, announced that they will be making some adjustments to their UST-3Crv liquidity pool on 8th May, in preparation for a much stronger 4Crv pool.

These conditions created the perfect opportunity for the attackers to strike. On the night of May 8th, these attackers began to execute their takeover plan.

The Plan

1. Manipulate UST-3Crv liquidity pool balance

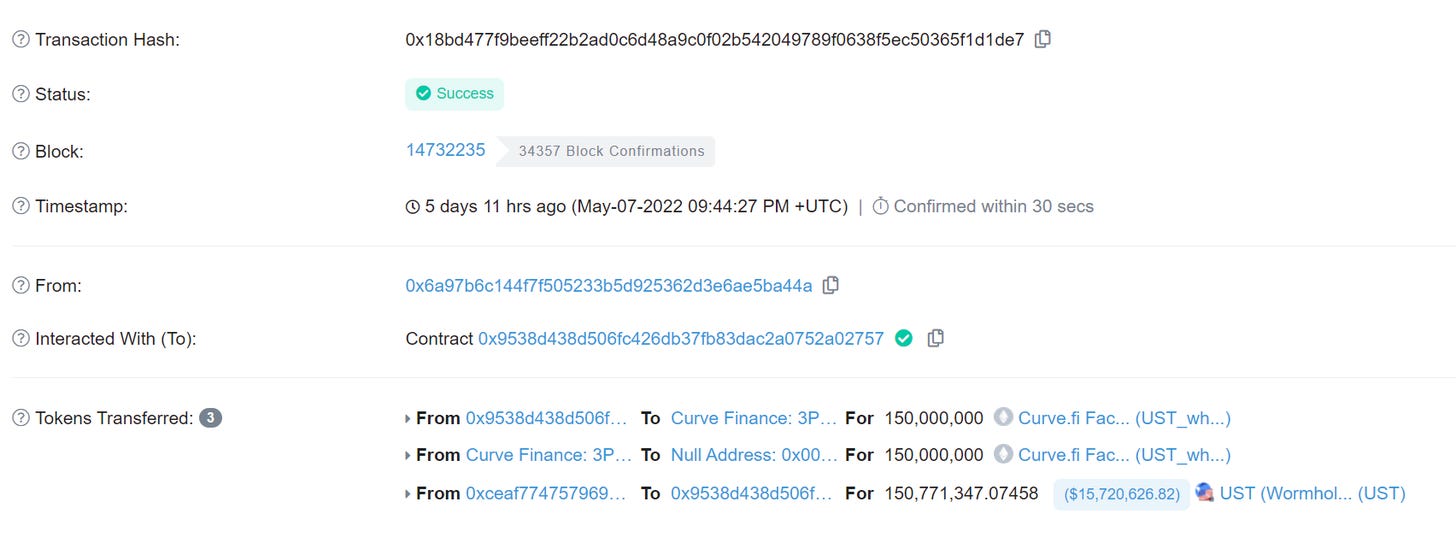

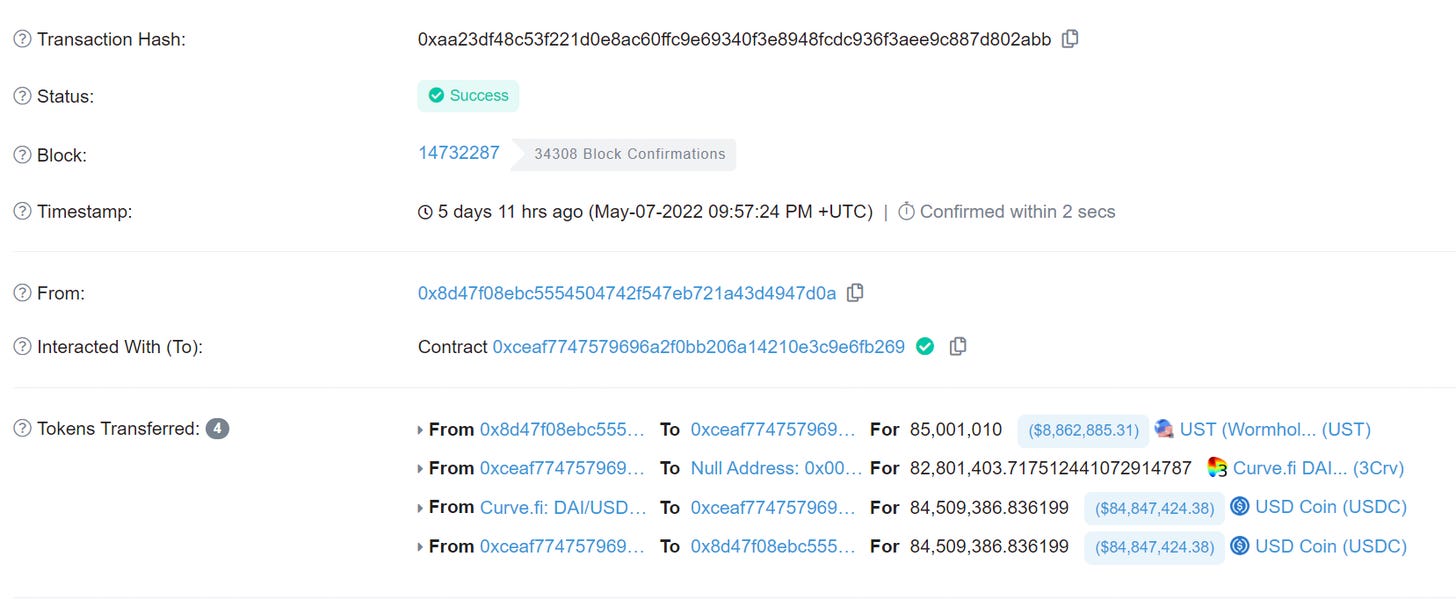

On the morning of 8th May, LFG withdrew $150M of UST from the UST-3Crv pool in order to prepare for the 4Crv pool. At that moment, there is only $700M left in the UST-3Crv pool, and it only requires $300M to dry up UST's liquidity.

Just 10 minutes later, a foreign address was seen transferring $85M UST out, which severely affected the 3Crv pool balance.

In order to maintain UST-3Crv liquidity pool balance, LFG subsequently withdrew $100M UST.

By then, rumours were spreading across Twitter, speculating that it was all LFG's own doings. Terra founder Do Kwon swiftly responded to it.

Not long after, multiple whale wallets are seen selling off UST on Binance, and they are all million-dollar transactions.

UST started to lose its peg after these massive dumps. Jump Trading (UST’s market maker) sold large amounts of ETH for UST, in attempts to stabilize UST's peg.

As of now, the address sold over 50,000ETH in order to stabilize UST's peg, and only had less than 13 ETH remaining.

The attack on the UST-3CRv required only $300M. If the 4Crv pool with $4B was built before this, the aforementioned attack would not work.

2. Massive Withdrawals from Anchor due to FUD

As UST depegs for close to 48 hours, FUD quickly spread across the community. Subsequently, large amounts of UST were withdrawn from Anchor, further worsening UST’s selling pressure.

At the same time, LFG has announced to “loan” $750M worth of BTC to help protect UST’s peg.

According to Do Kwon, UST that is above $0.95 is not considered depegged, hence no significant action is required. Is this an attempt to calm the masses because he knows shit is about to go down?

Ever since 8th May, UST did not return to its $1 peg (it was hovering around +- $0.95)

What LFG failed to realize was, alot of FUD was looming within the markets due to UST’s depeg. As more people withdrew UST from Anchor, UST’s peg dipped below $0.95. LFG was forced to tap on their Bitcoin reserves, as seen from Do Kwon’s tweet: “Deploying more capital”

Subsequently, an address starting with “0x559” started to absorb UST from the market, amounting close to $200M.

This allowed the UST-3Crv pool to quickly regain balance. However, Bitcoin’s further price decline led to the fall in price of other coins as well, including LUNA. Market sentiments continue to worsen, resulting in LUNA’s large-scale liquidation and increased selling pressure for UST. UST-3Crv pool quickly lost its balance after that.

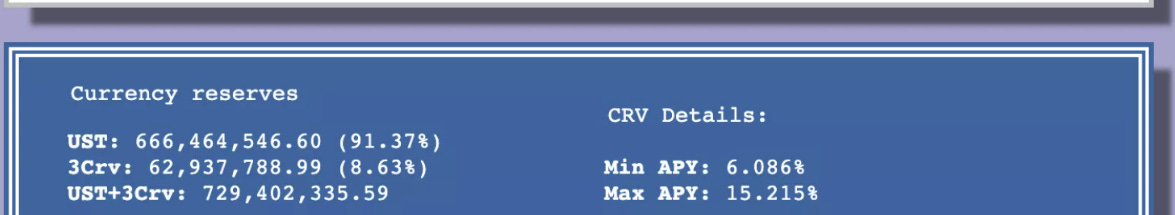

On the morning of 10th May, Jump Trading and LFG might have realized the problem and stopped selling its Bitcoin reserves to stabilize the peg. This resulted in UST plummeting all the way to $0.60. Although the price rebounded a while later, the proportion of the UST-3Crv pool remained severely unbalanced (91.37%/8.63%).

3. Backstage Deals, Rumours of Institutional Bailout

After the terrifying 2 hour death spiral on UST, rumours started to emerge, stating that Jump, Alameda and other institutions will provide $2B to bail out UST. Following that, an address starting with "0x6c" received a $2B deposit, but nothing else happened, leading many to believe that it had nothing to do with bailing out UST.

According to Uncommon Core's podcast host Hasu, Binance forcefully set a threshold price of $0.70 for UST, which disallowed users to place any orders below $0.70 for a period of time.

This morning, more LFG-financing related news emerged. According to sources, LFG is seeking help from institutions in hopes of raising $1B to support UST. According to Larry, a researcher at The Block, as of now, Jump Trading, Celsius and Jane Street have agreed to the financing, pledging about $700M. Alameda Research has not agreed yet. The institutions are asking to accumulate LUNA at a 50% discount, lock them for a year, and release them linearly every month after the vesting period. However, Larry emphasized that these are all unconfirmed and are subject to change.

More recently, GAM Holdings is rumoured to be “Terra's White Knight”, as reports state that they are negotiating with Terraform Labs (Terra) to help support its Luna stablecoin (UST). GAM is expected to invest between $2 billion and $3 billion to absorb excess supply of UST during its current selloff.

HOWEVER, after much digging I am confident to say this might very well be fake news. Why? You can refer to this thread here.

My point is, admist this entire crisis, it is extremely hard to discern official news from rumours, and it takes a calm mind to analyze any news being thrown around.

What’s so interesting about this entire saga?

Indeed, the amount that triggered the UST death spiral is no more than $300M, and the scale at large was only a few billion dollars, which is nothing compared to traditional finance. Interestingly, this happened in full view of the public, a phenomenon that is extremely rare for the general public to witness. Thanks to blockchain technology, we are able to observe explicitly how the first large-scale financial crisis in the crypto market went down.

This is not the first time UST has depegged and underwent a death spiral. During 19th May last year, UST had also lost its dollar peg, falling to $0.85. After some help from LFG, LUNA and UST were able to continue developing. Since then, in order to prevent such events from happening again, LFG has made some changes, which includes revamping UST's endorsement mechanism.

As a matter of fact, purchasing BTC and other L1 tokens as a form of endorsement is not necessarily a wrong decision. However, this requires some time for the new mechanism to achieve its full effect. Sadly, the markets did not give Do Kwon and LUNA maximalists enough time to redeem themselves, resulting in this catastrophe.

Many will also argue that it is Do Kwon’s arrogance that led to the downfall of Terra, a topic which we will get to in another article.

Regulations incoming?

As a seasoned DeFi investor, one should know that this depeg will not just affect the Terra ecosystem. Similar to Lehman's bankruptcy, Terra’s collapse may possibly affect the entire cryptocurrency market. The worst impact from this incident, in my opinion, may come from the regulatory side.

Countries around the world have been trying to popularize their own digital currencies (CBDC). UST, which was once labeled for its "stability", undoubtedly gave regulators the perfect chance to start clamping down on stablecoins. Currently, I feel people are much less worried about the recovery of an investor’s confidence, but rather more on what is going to happen with the regulation for stablecoins. Discussions about regulations have been spreading around Twitter, causing many concerns.

Sure enough, Treasury Secretary Janet Yellen will be testifying in front of U.S. House Committee on Financial Services, where she will be addressing questions regarding stablecoins. Yellen also stated that Congress needs to pass a bipartisan regulatory framework for stablecoins.

Will this be the end of stablecoins? Well, we don’t know. One thing for sure, new algorithmic stablecoins will not be seeing the light of day anytime soon.

Follow my socials if you have not! Subscribe to the substack to receive more articles like this :)

Twitter: @krakkenmunch